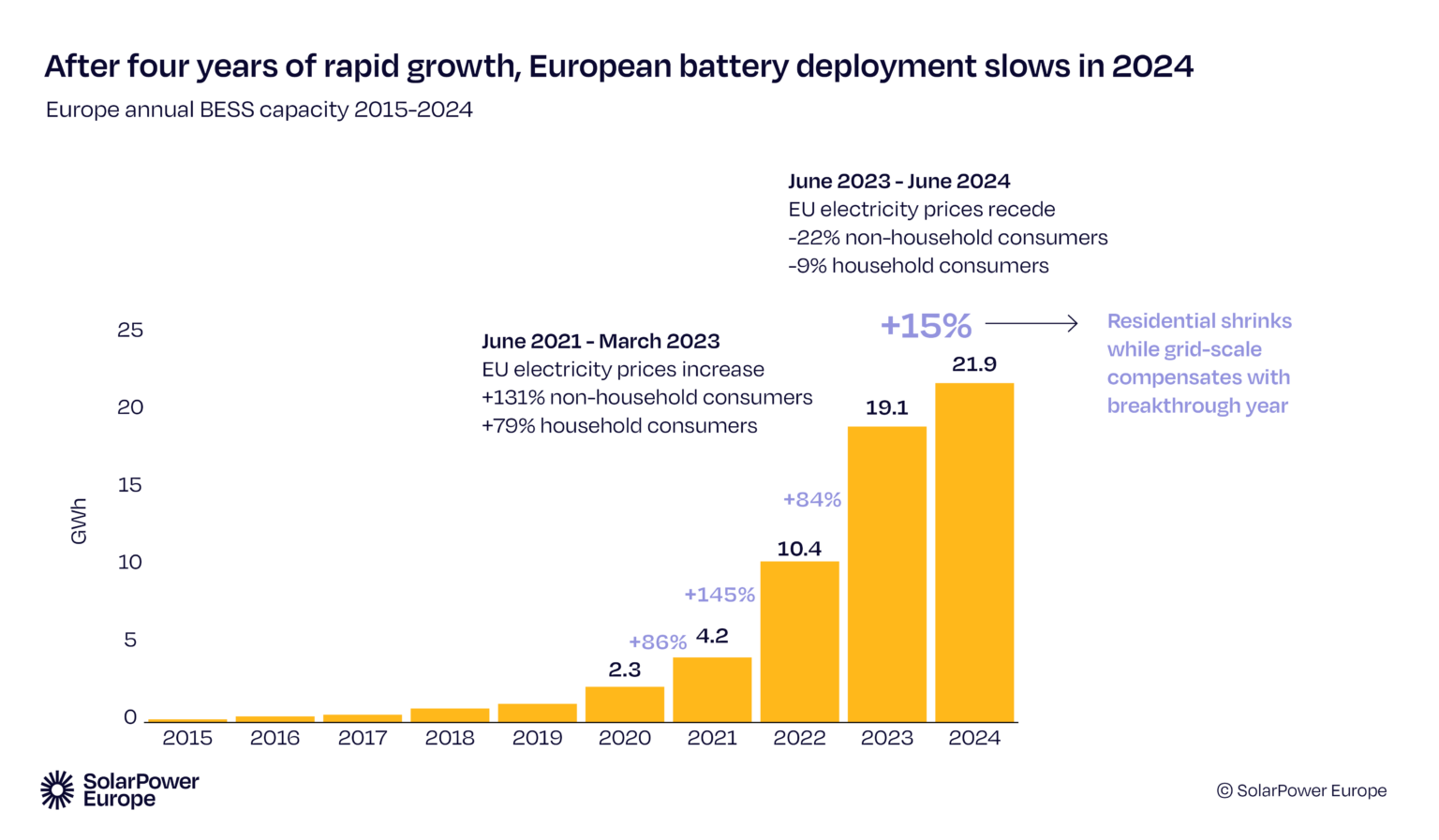

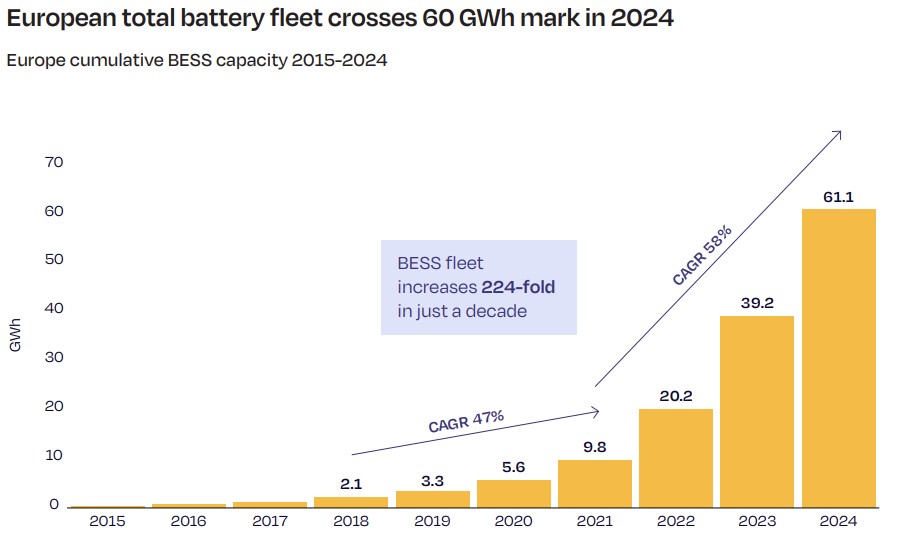

New European BESS installations reached 21.9 GWh in 2024, marking an eleventh consecutive year of record deployments despite growth slowing to 15% year-on-year, according to the European Market Outlook for Battery Storage 2025-2029 report.

The new installations bring Europe’s total battery fleet to 61.1 GWh, representing a significant deceleration after three consecutive years of doubling annual capacity additions. In 2023, for example, a 94% increase in installations was recorded, at 17.2 GWh.

The report includes the 27 countries in the European Union (EU-27), along with the UK and Switzerland, while noting that within the EU-27 itself, 18.5 GWh of BESS were installed in 2024, representing 85% of the total European installations.

The report forecasts accelerated growth in 2025, with projected installations of 29.7 GWh representing 36% annual growth. By 2029, total European capacity is expected to reach approximately 400 GWh (334 GWh in EU-27 countries).

However, this trajectory falls well short of the 780 GWh needed by 2030 to fully support the renewable energy transition, according to SolarPower Europe’s Mission Solar 2040 study.

“If Europe has already entered the solar age, the battery storage age is just beginning,” said Walburga Hemetsberger, CEO of SolarPower Europe, which produced the report. “Now is the time for European decision-makers to put batteries at the centre of a flexible, electrified energy system.”

Residential growth slows, grid-scale takes over

This deceleration in 2024 was previously anticipated. The report notes the “astounding surge observed during 2021-2023 was predominantly driven by the household segment as a direct response to the energy price crisis”.

Despite this anticipated decline, the residential market still installed almost 11 GWh, making it the leading battery storage segment in terms of annual volume. By the end of 2024, home solar and storage still accounted for 57% of Europe’s total accumulated BESS capacity. The residential segment, which has historically driven market growth, is projected to decline to 33% of new capacity as energy crisis-related support schemes wind down.

Where residential is falling, large-scale utility battery projects are set to dominate new installations for the first time in 2025. In 2024, grid-scale showed strong growth, with deployment surging by 79% to 8.8 GWh.

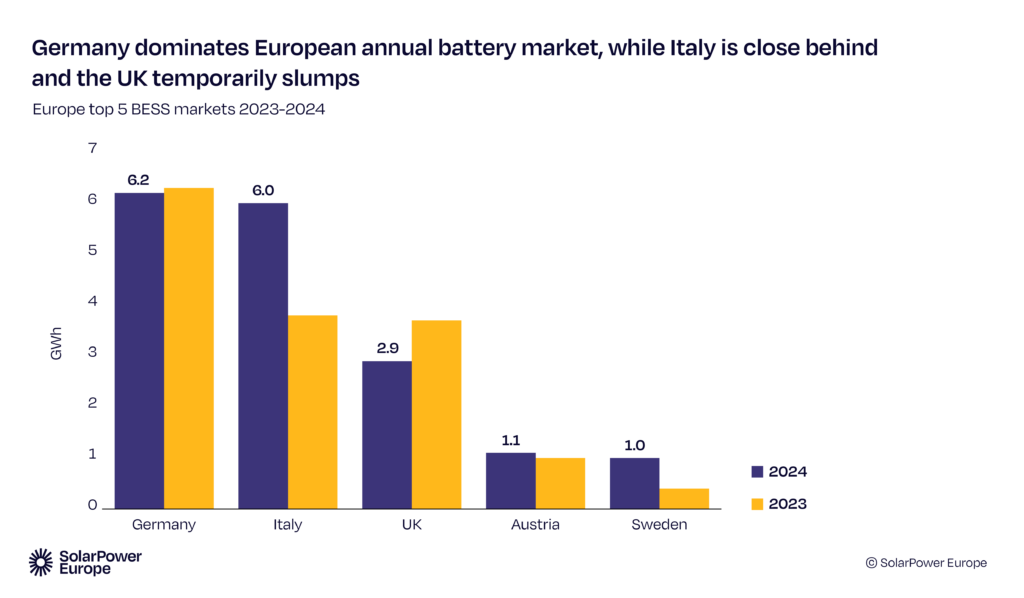

Country-specific data

Germany maintained its leading role with 6.2 GWh installed, similar to 2023, experiencing a 12% decline in residential installations but seeing growth in C&I (+26%) and a significant surge in utility-scale deployment (+140% to nearly 800 MWh), alongside a notable trend in small/micro-storage systems (<5 kWh), particularly for small battery systems associated with plug-in solar, which saw a 44% increase in the number of systems installed.

Italy ranked second with 6 GWh installed, achieving a remarkable 58% total increase driven by a stunning 15-fold surge in the large-scale segment (3.4 GWh), despite substantial downturns in residential (-19%) and C&I (-70%) installations.

The UK slipped to third with 2.9 GWh installed, a 22% decrease stemming from a 31% slump in large-scale deployment (2 GWh) primarily caused by project delays and grid connection backlogs, though its behind-the-meter segment grew significantly (+840 MWh), with residential increasing by 13% due to supportive policies and high retail prices.

The Spanish market installed less than 250 MWh in 2024, ranking 14th in Europe and representing a 41% decline from 2023. However, Spain is projected to become a top-five European market in 2025 with 1.3 GWh of expected installations as utility-scale projects revive.

Plan to grow storage further

“Europe’s solar success has laid the foundation – now battery storage is stepping into its pivotal role,” said Markus Elsaesser, CEO of Solar Promotion. “If we apply the same focus and ambition to storage that we once did to solar, Europe can build a resilient, renewables-based energy system faster than many think.”

SolarPower Europe is advocating for an EU Energy Storage Action Plan to harmonize markets, reform grid connections, ensure market access for BESS, create competitive balancing markets, and enhance smart metering standards.