Last year marked a historic inflection point for battery energy storage systems (BESS), as global operational BESS capacity surpassed 250 GW, overtaking pumped hydropower energy storage (PHES) for the first time, Rystad Energy reports.

Annual additions exceeded 100 GW/280 GWh in 2025 – nearly triple the volumes added in 2023 – reflecting a compound annual growth rate of over 100% between 2020 and 2025. This rapid expansion makes BESS one of the fastest-growing energy technologies of the decade, according to Rystad’s Energy Storage Outlook whitepaper.

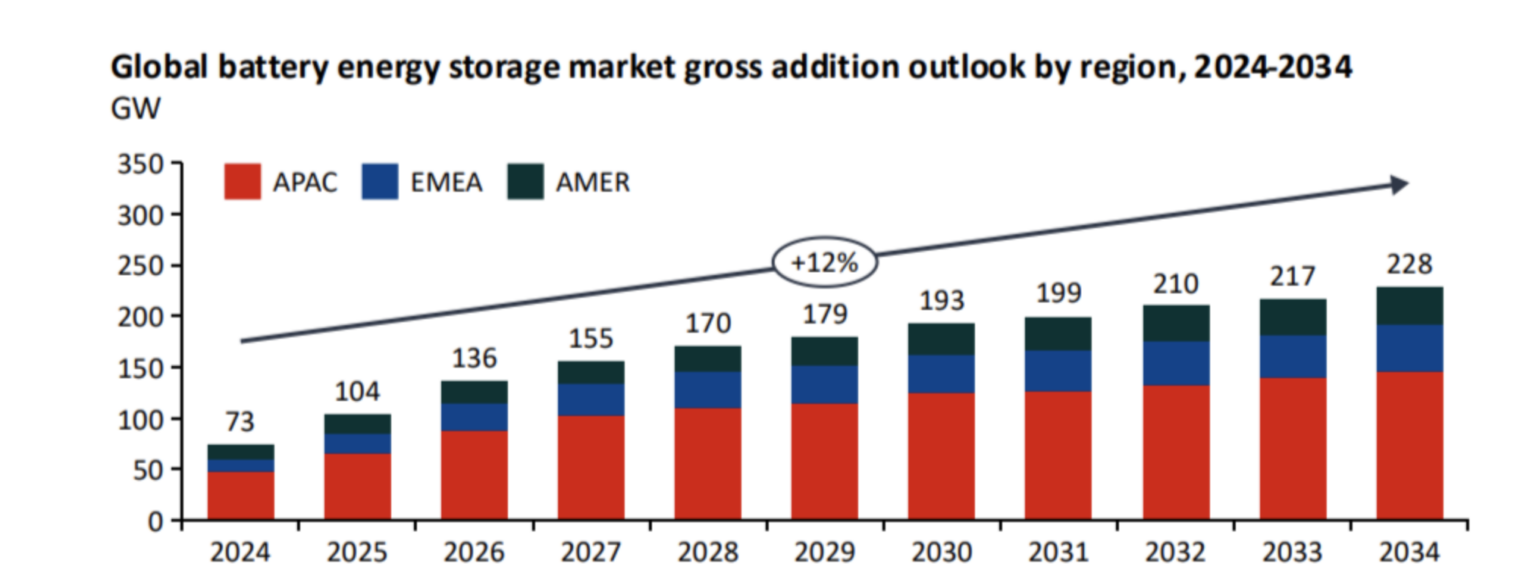

Deployment momentum is expected to accelerate further in 2026, with global BESS additions projected to exceed 130 GW/350 GWh. Established markets such as China, the US, the UK, Australia, and Germany will continue to lead, while emerging markets – including Italy, Saudi Arabia and the wider Middle East, Chile, and Eastern Europe – are gaining prominence as policy frameworks, grid needs, and project pipelines align.

Rystad highlights a notable milestone: BESS is no longer merely supporting renewables – it is beginning to replace gas generation. In 2025, battery generation in Victoria, Australia, surpassed gas-fired output for the first time. Similar transitions are expected in New South Wales and Queensland in 2026. In California, batteries accounted for more than 20% of evening generation in April 2025, a role previously dominated by gas plants, thus extending the availability of renewable energy beyond daylight hours.

Rystad also examines falling BESS costs, describing the pace of decline as moderate. In 2025, total turnkey BESS costs in China fell by approximately 15%, reaching levels as low as $150/kWh, benefiting markets with strong exposure to Chinese suppliers and accelerating installations.

Looking ahead to 2026, however, reduced export tax rebates in China and rising lithium prices are expected to slow cost deflation. Rebate changes could raise cell and container prices by around 6% per phase, while lithium price recovery may add a further 2–5% to system costs, Rystad calculates.

Despite moderating prices, BESS is becoming economically viable across an expanding range of regions. Continued technology improvements are extending system lifetimes beyond 20 years and 10,000 cycles. At a capital cost of around $200/kWh, this translates into a levelized cost of storage of roughly $50/MWh, or lower under favorable conditions, Rystad finds.

In regions with stable solar resources, co-located solar-plus-BESS projects are increasingly the most competitive source of new power generation.

Meanwhile, mrchant revenue opportunities are also drawing growing investor interest. Rystad notes that in liberalized markets, energy arbitrage and ancillary services revenues have proven sufficient to support standalone BESS investment. While emerging markets still offer largely untapped ancillary service opportunities, mature markets such as Australia, the UK, and California (CAISO) are seeing a shift in revenue composition, with energy trading accounting for a rising share of total BESS revenues.