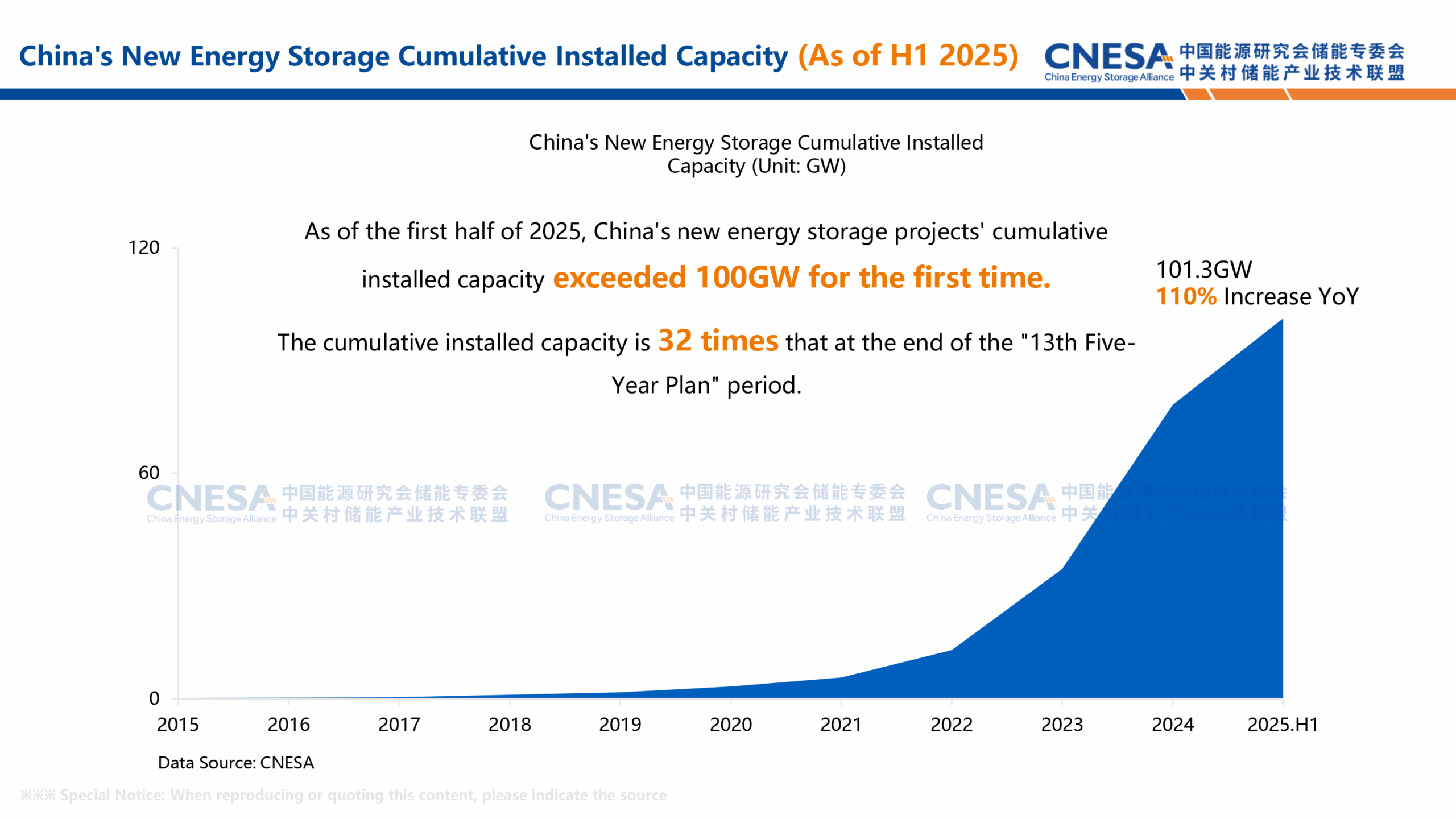

China’s new energy storage market reached a milestone in the first half of 2025, according to a report released by the China Energy Storage Alliance (CNESA) at the Western Energy Storage Forum in Hohhot, Inner Mongolia, earlier this week.

CNESA said China’s total energy storage fleet stood at 164.3 GW at end-June, up 59% year-on-year, while cumulative new-energy storage – primarily lithium-ion battery energy storage systems – surpassed 100 GW for the first time, reaching 101.3GW (a 110% increase compared to last year).

The report documents a structural transformation in China’s storage mix. Pumped hydro, which accounted for 89.3% of capacity at the end of the previous five-year period, has fallen to 37.4% of the fleet; lithium-ion now represents 59.9%. CNESA characterizes the change as a fundamental technology-route shift as the industry moves from a single-track to a multi-path landscape.

Installation activity was intense in H1 2025. New-energy storage added 23.03 GW of power output (56.12 GWh of storage capacity) in the six-month period, both metrics up about 68% year-on-year. Installation surged around a grid-connection deadline – reported as May 31 – when a single month (May) delivered 10.25 GW/26.03 GWh of new capacity, rises of 462% and 527% respectively on the prior year. CNESA attributes the spike to policy timing and accelerated market-driven deployment.

On supply-chain dynamics, Chinese companies shipped 233.6 GWh of battery storage cells in H1 (excluding cells for base stations and data centres). CNESA groups suppliers into four tiers: CATL (Contemporary Amperex) alone in the ≥50 GWh band; a 20–50 GWh tier dominated by BYD, CORNEX, Ganfeng LiEnergy, CALB, Hithium and EVE; a 10–20 GWh band including Envision, Gotion and Rept Battero; and smaller suppliers such as China Automotive New Energy, Guangzhou Great Power and Sunwoda in the <10 GWh group. CNESA notes the second-tier firms are narrowing the gap with market leader CATL.

System integration markets show domestic–international divergence. China’s top ten domestic integrators are led by CRRC Zhuzhou Institute, Hyperstrong, Envision and Sungrow; on a global shipments’ basis Sungrow, CRRC Zhuzhou Institute and Hyperstrong top the list, followed by Envision, China Electric Equipment Group and others including Sunwoda, Canadian Solar and Trina Storage.

Procurement and pricing trends lead to increasing centralized buying. CNESA found that 86.2 GWh of storage systems were awarded in H1—up 264%—with collective or framework purchases accounting for 69% of awarded volume. On the tender side, state-led procurers dominated, and winners such as Hyperstrong, CRRC Zhuzhou Institute and BYD captured the most lots. Average awarded prices fell: 0.5C system awards averaged CNY 553.52/kWh (-28% y/y) and 0.25C systems CNY 446.80/kWh (-69%); EPC averages also softened.

Looking ahead, CNESA expects the sector to shift from scale-driven competition to value-led differentiation. It forecasts China’s new-energy storage capacity could reach 236.1 GW under a conservative scenario—or exceed 291.2 GW in an optimistic case—by 2030, implying about 20% compound annual growth through the remainder of the decade. CNESA emphasizes market-design, capacity-valuation mechanisms and diversified application scenarios – virtual power plants, green-power direct links and large-scale desert bases – as keys to future value creation.